World Defense Show 2024: The show’s second iteration adapts to a changing world

FNSS Pars Alpha 8x8 will target a large Turkish requirement and international customers. (Photo: Author)

The second edition of the World Defense Show (WDS) in Saudi Arabia may have been located some 75km from the capital Riyadh, but its return was a bigger, brasher affair than the first edition in 2022. Taking place in the face of a charged geo-political environment, the 2024 event was said to be better organised according to veterans of the show, with 750 exhibitors and 115 delegations from 45 countries in attendance.

The stands were dominated by vehicles, weapons and CUAS systems, reflecting new views influenced by current conflicts. The hamstrung stature of Russian industry, less popular and singularly working hard to meet local demands, also had an impact on what was on display at the show.

Makers wheeled out their products

Despite three halls of exhibitors and a courtyard full of vehicles on display, there were notable absences at the show this year. Unlike the European market which has been engaging in a resurgence of tracked IFVs and tanks, the show featured just two large-tracked combat vehicles, including the British Army’s much-plagued Ajax which has remained unlikely to be offered to the export market in the near future.

Related Articles

World Defense Show 2024: BAE Systems to demonstrate USV system at Defense Services Asia

World Defense Show 2024: First NiDAR CUAS set for combat ships

World Defense Show 2024: Bigger bang for Tulpar as Otokar adds 120mm tank gun

Otokar Tulpar medium tank fitted with Italian Leonardo HITFACT Mk II turret armed with a 120mm smooth bore gun. (Photo: Shephard Defence Insight)

Otokar’s new offering, unveiled at WDS 2024, was its existing Tulpar IFV mounted with a Leonardo HITMARK II 120mm cannon and promptly labelled as a ‘medium tank’ stood in isolation at a show that appeared decisively focused on wheeled platforms.

In contrast, FNSS and BMC, as well as Otokar with its Arma platform – all leading contenders in the Turkish Next Generation Light Armoured Vehicle programme – offered 105mm and 120mm options on their 8x8 vehicles. A spokesman from FNSS confirmed at the show that it believed the 120mm option on its new Pars Alpha would rival the standard 30/40mm turret in popularity among future customers.

Looking beyond the Middle East

WDS has been positioning itself not just as a spotlight for the future Saudi Arabian defence vision, but as a key event globally within the industry, seeking to attract manufacturers and delegations from beyond the Middle East.

Unsurprisingly, Turkey had a dominating presence at the show, with the largest pavilion and an armada of vehicles to rival other countries’ inventories on display.

Otokar showcased a variety of its platforms paired with weapon systems from John Cockerill and Leonardo. It shared the floor with FNSS and the Pars Alpha 8x8 vehicle which was unveiled at the show. BMC’s 8x8 Altuğ and 4x4 Kirpi, along with Nurol Makina’s recent European success the Ejder Yalçın 4x4, were also exhibited.

For Saudi Arabia, however, WDS was an opportunity to demonstrate the rapid expansion of its domestic market, where it has seen an explosion of new 4x4 APCs.

In a mirror of much of European and North American development, UGVs continued their steady expansion in variety and exposure, with General Dynamics’ brimstone-equipped TRX, Milrem’s THeMIS, Jamla Holding’s DAISAM-1 and Hyundai Rotem’s Sherpa all on display.

Countering the drone boom

The Ukraine war and regional events in Gaza, Israel and the Red Sea had cast a shadow over the show and the prevalence of CUAS systems, new and old, proliferated.

MARSS revealed contracts for a static CUAS system and also the first deal to install its NiDAR on navy combat ships, while other companies including BAE Systems and Allen-Vanguard highlighted their capabilities and programmes in the field of combating unmanned systems.

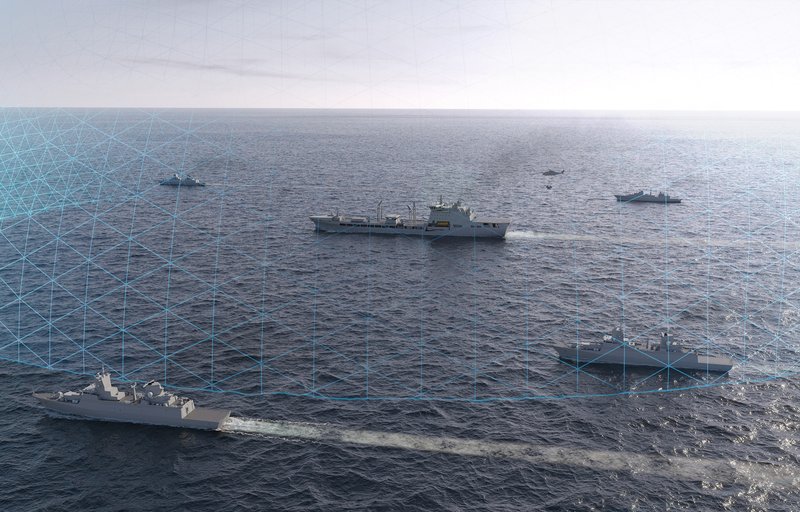

The first ship in the MARSS NiDAR deal will be expected to be completed in 2026. (Image: MARSS)

Advanced Protection Systems (APS) quietly displayed its newest CUAS system, cashing in its success with detecting UAS in the Ukraine war. While that was a detector, its newest product, the omnidirectional first-person view (FPV) drone neutraliser, has been designed to create a half-kilometre dome to deny small UAS access across seven RF bands.

Contained in a carry case it has been designed to serve for static deployment or vehicle carried and can jam UAS. It was described by the company as “one of the elements of its SKYctrl system and controlled by the company’s CyView C2 system”.

The war in the Ukraine has sharpened the minds of industry leaders as they follow the demands and expectations of users and buyers, many who have watched explicit footage of small UAVs attacking large vehicles, irrelevant of how significant these attacks have proven in the scope of a massive ground war.

In the case of one company, it decided to deter any Russian window shoppers from its products with a discretely placed small Ukrainian flag.

Unsurprisingly, the naval presence at the show was limited to models of ships and subsystems such as Fincantieri who displayed a model of its new FCX30 light frigate design which has built on Qatar’s Al Zubarah-class.

China’s noticeable presence

The Chinese section was somewhat other-worldly with a swathe of UAV products which could be cousins of western products but certainly indigenous in design without any effort to copy similar US products.

The broad sweep of UAV models and mock-ups in the Chinese section looked to fulfil precisely the roles as those produced by western companies, covering the sweep from large to medium-altitude long-endurance, through to quadcopters and loitering munitions.

China had a big presence at WDS 2024. (Photo: Author)

On the wet side there was a large almost lifesize S45 fast interceptor and an array of models of UUVs and USVs such as the Thunderer A2000 attack USV, 300-ton unmanned combat surface vessel and Lancer P85 patrol USV.

The potential of any of the designs on show going beyond plastic models was possibly limited but it did demonstrate that, as with commercial industry and its army of model builders with representations that go nowhere, there has been much thought going into the possible.

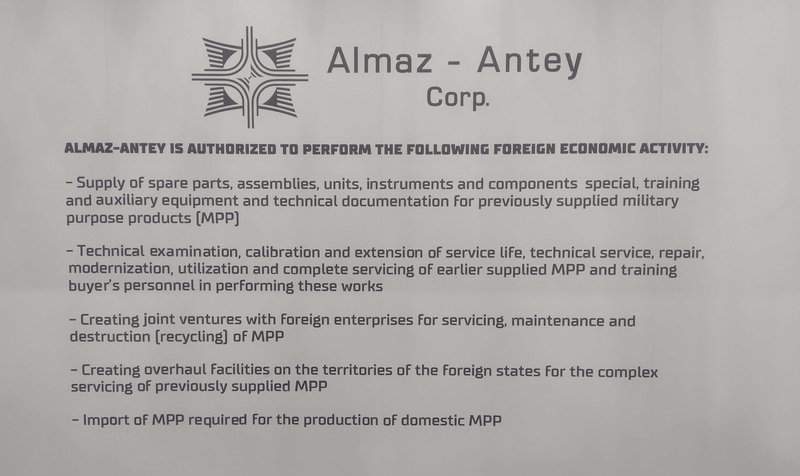

Russia frozen out

Despite its large presence at WDS, the cascading effect of the Ukraine-Russia conflict was on display on the Russian Pavilion. Significant restrictions on ‘foreign economic activity’ were clearly signposted by Russian companies in what could be considered a blow to a region traditionally reliant on old Russian/Soviet exports such as BMPs and T-model tanks.

A sign of the times at WDS 2024: nothing for sale. Russian company's have been busy keeping up with demand at home rather than exporting. (Photo: Author)

Russia’s newfound inability to export any new military purpose products (MPP) may, however, already have found a replacement. A considerable Chinese contingent displaying a full domain spectrum of products in a pavilion only outsized by the regional military industry powerhouse of Turkey appeared poised to step into the gap.

Open to both east and west, WDS unsurprisingly provided a stark contrast to DSEI and AUSA with its inclusion of rarely seen Chinese military industry.

China’s offerings, however, differed from almost all other platforms on display – especially those from the Turkish manufacturers – in one crucial aspect: unless China’s military industry has been at least five years behind the West, the vehicles, airframes and ordinance displayed at WDS were almost certainly geared towards a more traditionally frugal Middle Eastern market.

Mass-produced, cheaper than Western alternatives, and – crucially – not embargoed or burning in a Ukrainian field, Chinese platforms appeared set to become the import of choice for the second-hand Middle Eastern market.

Shephard's World Defense Show 2024 coverage is sponsored by:

Related Programmes in Defence Insight

New Generation Light Armoured Vehicles - Wheeled [Türkiye - Batch I]

Related Equipment in Defence Insight

More from World Defense Show 2024 | View all news

-

![World Defense Show aims to expand global reach and innovation]()

World Defense Show aims to expand global reach and innovation

The Saudi Arabia defence industry showcase will return in 2026 with promises of more innovation and technologies from around the world.

-

![World Defense Show 2024: Maxar on course to have six observation satellites in orbit this year]()

World Defense Show 2024: Maxar on course to have six observation satellites in orbit this year

WorldView Legion, a fleet of high-performance satellites, will expand Maxar’s ability to revisit the most rapidly changing areas on Earth to better inform critical, time-sensitive decisions.

-

![World Defense Show 2024: The show’s second iteration adapts to a changing world]()

World Defense Show 2024: The show’s second iteration adapts to a changing world

Saudi Arabia’s welcomed the return of the World Defense Show with the event’s heavy focus on vehicles and CUS systems reflecting ongoing conflicts and the priorities of many national programmes.

-

![World Defense Show 2024: Advanced Protection Systems unveils new CUAS jamming system]()

World Defense Show 2024: Advanced Protection Systems unveils new CUAS jamming system

Advanced Protection Systems (APS) has history in the radar and CUAS areas with systems in service in Ukraine. It has a family of SKYctrl systems ranging from a comprehensive system to lightweight portable, mobile, containerised and Skid which includes a hard-kill gun.

-

![World Defense Show 2024: New version of Jais Mk2 unveiled]()

World Defense Show 2024: New version of Jais Mk2 unveiled

A new version of the Jais mine-resistant armoured protected (MRAP) vehicle, was unveiled at World Defense Show 2024.

-

![World Defense Show 2024: L3Harris MissionOps set for first deployment by mid-year]()

World Defense Show 2024: L3Harris MissionOps set for first deployment by mid-year

L3Harris’s MissionOps is a tactical network management suite which is designed to consolidate core capabilities and deliver them in a single software package.